5 Which of the Following Would Be a Progressive Tax

What can you say about the two figures. For 2021 there are only seven tax.

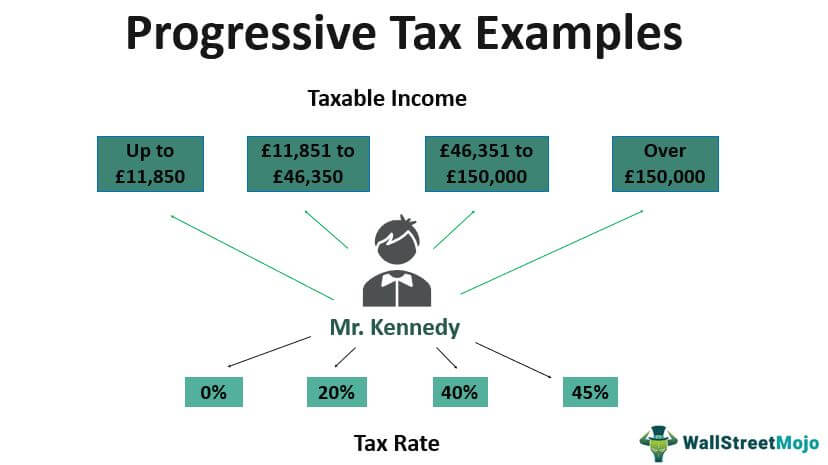

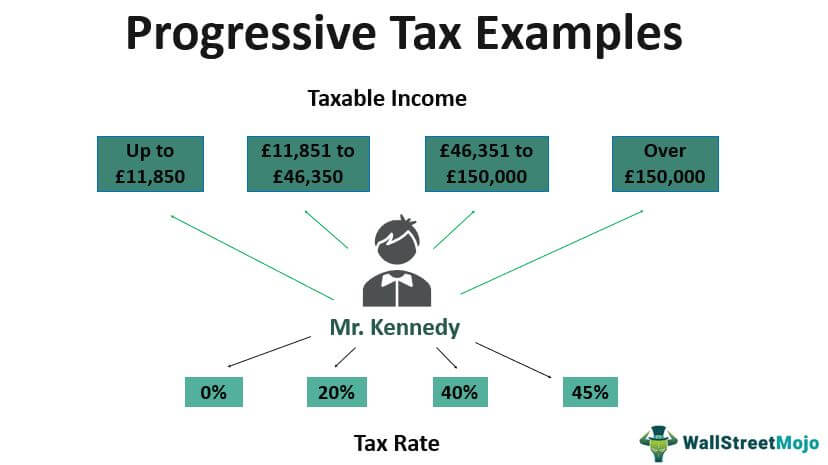

Progressive Tax Explained Raisin Uk

Percentage of income paid as taxes increases as income increases.

. Which of the following taxes is a progressive tax. The calculator below gives you the tax amount and sum remaining after taxes calculated with a progressive tax scale. The average tax rate is.

The first tax rate of 10 applies to incomes of less. Context larsen and toubro indian oil corp. BAll people pay a 15 percent income tax.

Please select all that apply. For example income taxes increase according to the purchasing power of the individual high-income individuals pay higher rates than those with low-income to facilitate the burden of taxes on families with little. 1211 for the bottom tax base.

Federal income tax is based on the progressive tax system. Ltd and renew power have agreed to form a joint. Complete the progressive tax chart below.

A progressive tax is such that. Question 12 051 pts Which of the following is true about a progressive tax system. The spatial distribution of minerals is uneven.

Additional taxes such as the municipal tax which has a country average of 24. The more a person earns the greater their tax burden. A tax system that is progressive applies higher tax rates to higher levels of income.

A married taxpayer has taxable income of 77381. New Jersey California are states with more progressive tax systems Lower-income people pay a greater portion of their income than do those upper-income people Upper-income people pay a greater. Progressive taxes make use of marginal tax rates.

Tax Round your answer to the nearest whole dollar amount. Marginal tax rates. O a It is the least effective type of automatic stabilizer.

This design leads to higher-income individuals paying a larger share of income taxes than lower-income individuals. An income tax is progressive if the. There are several different tax brackets or groupings of taxable income which are taxed at.

To find the amount of tax use this formula. Oь The less a person earns the greater their tax burden. Chapter 01 - Introduction to Taxation the Income Tax Formula and Form 1040EZ 32.

To find the amount of tax use this formula. Progressive taxes are those that increase according to the value being taxed. Income Progressive Range Tax Rate 0 3000 3001 5000 2 3 5001 17000 5 17001 and up 575 Calculate the state income tax owed on an 80000 per year salary.

APeople earning 35000 pay 10 percent tax while people earning 100000 pay 30 percent tax. A certain state uses the following progressive tax rate for calculating individual income tax. Income is taxed on the extra income earned eg.

In 2021 federal progressive tax rates are 10 12 22 24 32 35 and 37. Income Progressive Range Tax Rate 0 - 2000 2001 - 9000 2 5 9001 and up 54 Calculate the state income tax owed on. Just enter your income adjust the progressive scale according to your taxation category and get your taxes calculated along with the remaining sum and total tax percentage.

The tax scale table default values are for US. Higher rate of income tax is charged at 40 on income above 36000. You have calculated tax liability using the tax tables and using the tax rate schedules.

This is a one-of-a-kind. In the US federal income tax is a progressive tax. A progressive tax system might for example tax low-income taxpayers at 10 percent middle-income taxpayers at 15 percent and high-income taxpayers at 30 percent.

Jake earned 15000 and paid 1500 of income tax. Federal income tax is based on the progressive tax system. Jitendra singh the union minister of state independent charge for science and.

Context the union culture ministry has established the temple 360 webpage. Question 2 5 points 0309 MC Which of the following statements about a progressive income tax structure is accurate. A progressive tax system might for example tax low-income taxpayers at 10 percent middle-income taxpayers at 15 percent and high-income taxpayers at 30 percent.

Then marginal income is taxed at 25. The tax rate structure they are subject to. Example of Progressive tax.

Federal taxes operate under a progressive system. 15 for the top tax base or income exceeding DKK 544800. Is considered a progressive system although it has been growing flatter in recent decades.

Economics questions and answers. Which of the following would be a progressive tax. The individual income tax has rates that range from 10 percent to 37 percent.

Denmark has the following state tax rates regarding personal income. A certain state uses the following progressive tax rate for calculating individual income tax. Consider the following statements with regard to the mining industry of India.

DEveryone pays a 5 percent sales tax. Income tax threshold of 5000 means you dont pay any income tax on first 5000. 2 custom tax.

The income tax system in the US. Economics questions and answers. 1 income tax.

In the US. A progressive tax is a tax in which the tax rate increases as the taxable amount increases. People who make less than 9950 pay 10 in taxes while people who make more pay a higher rate of tax up to 37.

CPeople pay 10 percent tax on property whether it is worth 50000 500000 or 50 million. Complete the progressive tax chart below. Which of the following normally a progressive tax.

Jill earned 40000 and paid 3500 of income tax. Tax rates are higher the greater ones income.

Three Different Types Of Taxation Policies Entrepreneurship Articles Different Types Type

Progressive Tax Economics Help

Progressive Tax Examples Top 4 Practical Examples With Calculation

Belum ada Komentar untuk "5 Which of the Following Would Be a Progressive Tax"

Posting Komentar